This year, Asia's tokenized real estate market is rapidly surpassing that of Europe.

Regulators in Singapore and Japan have fast-tracked blockchain-friendly policies that slash issuance timelines from months down to weeks. Retail investors are pouring into platforms with low minimum buys, driving trading volumes to record highs. Fintech hubs across Hong Kong and Tokyo are fueling projects with capital and infrastructure support. Meanwhile, emerging markets like Indonesia and Vietnam are leapfrogging legacy systems with mobile-first tokenization apps.

These shifts have paved the way for Asia to surge ahead.

In this edition we will unpack the forces driving Asia’s rapid rise and Europe’s measured approach to help you navigate these dynamic markets, but before that, check out this week’s sponsor!

This headshot tool is changing how people get hired

Before anyone reads your resume, they see your photo. And if your headshot doesn’t scream “credible, confident, professional” — you’re getting skipped.

InstaHeadshots is the world’s most realistic AI headshot generator. Just upload a few selfies, and in 5 minutes, get over 100 stunning, studio-quality headshots in multiple styles — perfect for LinkedIn, CVs, websites, and more.

No awkward photoshoots. No fancy camera needed. Just better opportunities, starting with a better photo.

✅ Want to stand out like 150,000+ professionals from Google, Microsoft, Amazon, Goldman Sachs, and more?

How Asia’s Tokenization Boom Is Reshaping Global Investment Norms

Regulators in Japan, Singapore, and Hong Kong have streamlined approval processes, enabling projects to go live in weeks instead of months.

Retail platforms are lowering entry points to as little as $50, attracting first-time investors across Southeast Asia. Government-backed blockchain sandboxes in Thailand and Indonesia are funding pilot tokenization schemes for residential and hospitality assets. Institutional players are also taking notice, with several Asian sovereign wealth funds exploring hybrid STO-REIT structures.

This convergence of policy, technology, and capital has ignited a wave of tokenized offerings that outpace traditional real estate commerce.

Progressive regulatory frameworks by the FSA (Japan) and MAS (Singapore) accelerate issuance timelines.

Large unbanked and underbanked populations drive demand for accessible investment vehicles.

Mobile-first application designs cater to smartphone-savvy Asian consumers.

Public-private blockchain incubators provide funding and technical support.

High tourism growth in markets like Indonesia generates attractive yields for tokenized resorts.

We aim to democratize real estate investment by enabling fractional ownership through tokenization, ensuring compliance with EU and U.S. regulations while providing liquidity via our PropXChange marketplace.”

Europe’s Tokenization Market Delivers Stability Through Regulatory Certainty

With MiCA’s rollout in December 2024, European issuers gained a unified legal framework that reduces compliance ambiguity and cross-border friction.

Leading jurisdictions like Switzerland, Germany, and Luxembourg offer clear licensing pathways for security token offerings, instilling investor confidence. Established financial institutions are integrating tokenization modules into existing platforms, blending legacy expertise with digital asset innovation. Demand from family offices and pension funds for diversified, liquid instruments has catalyzed multiple pilot programs.

This deep-rooted commitment to regulatory compliance and institutional integration underpins a stable, scalable tokenization ecosystem across Europe.

MiCA provides a single set of regulations for EU member states, simplifying legal requirements.

National laws like Germany’s Electronic Securities Act codify tokenized asset standards.

Major banks and custodians are partnering with blockchain firms to offer STO services.

Pension funds and insurance companies seek regulated digital instruments for portfolio diversification.

EU blockchain observatories fund research into interoperability and standardization.

🏙️ Stay on top of the future of investments

(real estate tokenization news, 23rd to 30th of June 2025)

Dubai Land Department Launches MENA’s First Tokenized Real Estate Project

The Dubai Land Department (DLD) has rolled out the Prypco Mint platform, enabling fractional ownership of ready-to-own Dubai properties starting at AED 2,000 (~US $545), with all transactions settled in UAE dirhams during its pilot phase. The initiative integrates property details—pricing, risk factors, technical specs, and minimum investment thresholds into a transparent, blockchain-backed interface, marking the region’s first government-endorsed tokenization effort. (learn more)

The New REITs Are Tweets: How Social Capital Is Driving Real Estate Tokenization

A Medium feature explores how tokenized real estate offerings are increasingly launched via social channels, with creators leveraging Twitter and newsletters to build communities, whitelist investors, and drive fractional property sales. The article notes that global tokenized real estate volumes have surged to over $1.2 billion as of June 2025, illustrating the power of direct-to-investor social engagement. (learn more.)

Real Estate Tokenization Bridges Ownership Gaps in Kenya (June 26, 2025) Yeshara, in partnership with Kenya’s Capital Markets Authority, is enabling Kenyans to invest in tokenized properties starting at USD 100. This initiative uses blockchain to offer fractional ownership, making real estate accessible to everyday investors. (learn more.)

EstateX Launches ESX Token Backed by Tether Founder and RE/MAX CEO

EstateX co-founder discusses a tokenized real estate platform. EstateX’s Bart De Bruijn shared insights on their blockchain-based platform, emphasizing its secondary marketplace, PropXChange, for 24/7 token trading. The platform ensures compliance with EU and U.S. regulations and offers liquidity through fractional ownership. (learn more.)

New Book Explores the Emergence of the Asset Tokenization Industry

Released June 25, “Asset Tokenization—The Arrival of a Transformative Trillion-Dollar Industry” traces the historical evolution and future potential of tokenizing real-world assets—real estate chief among them. Author Michael Juul Rugaard examines how regulatory frameworks, technological advancements, and market demand coalesce to shape a burgeoning tokenization ecosystem across global capital markets. (learn more.)

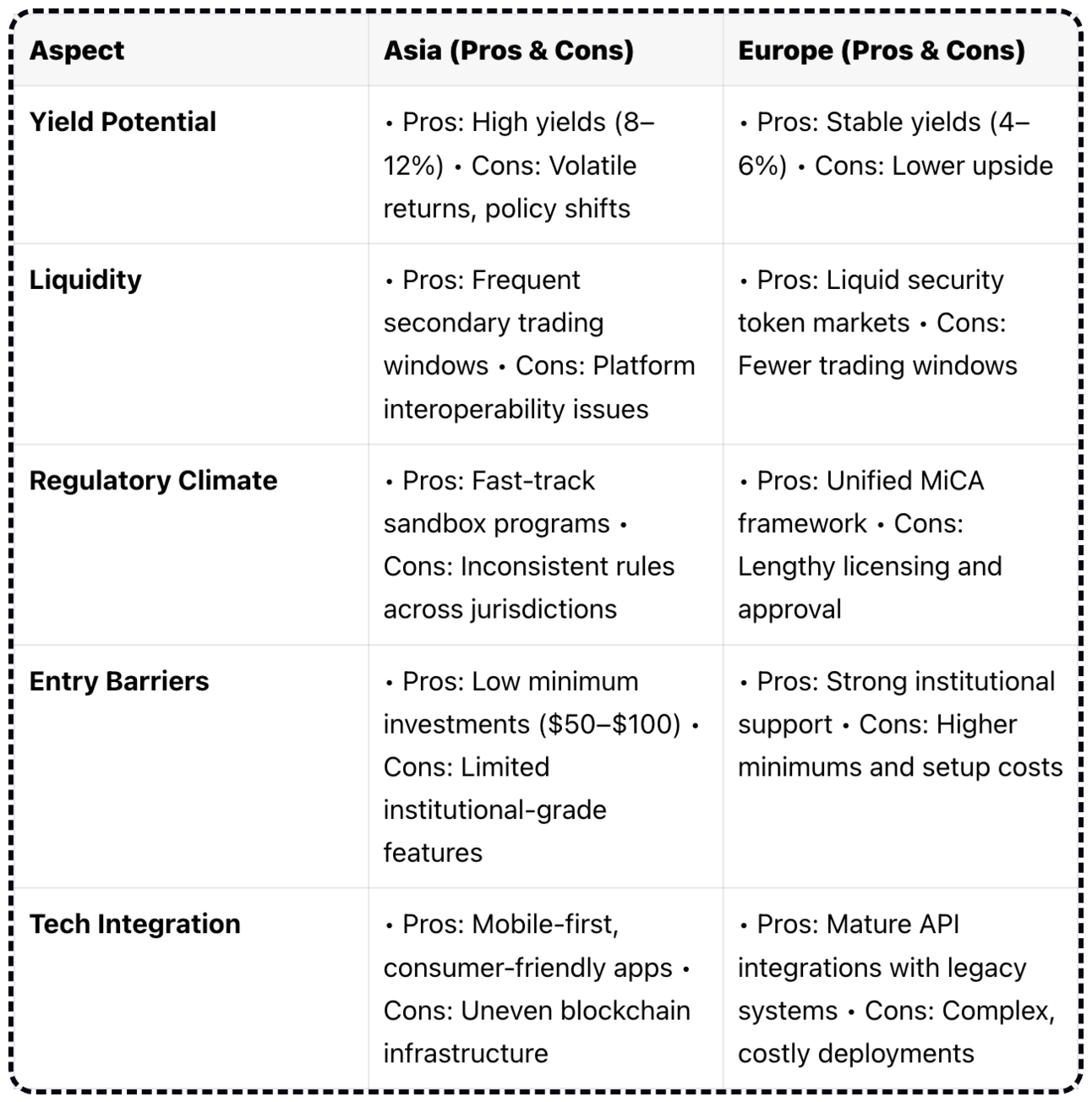

Balanced Portfolios Leverage Asia’s Growth and Europe’s Security

Asia offers explosive high-yield opportunities driven by rapid regulatory innovation and retail enthusiasm, yet regulatory fragmentation and uneven blockchain infrastructure can introduce sudden policy risks.

Europe delivers steadier returns under MiCA’s unified framework and deep institutional backing, but higher entry thresholds and slower issuance processes can dampen agility. Savvy investors now split allocations—tapping Asia’s dynamic upside with a satellite position while anchoring core holdings in Europe’s transparent, compliance-driven markets. Token dashboards and real-time analytics let you monitor and rebalance exposures instantly, optimizing for both growth and risk mitigation.

Below is a head-to-head comparison to help you decide where and how much to allocate.

Pros and Cons

Thats a wrap for today

Talk soon,

Kevin

Do you have any questions about real estate tokenization?

We’re here to help you make informed decisions—not to sell you something you don’t understand.

At Bali Invest, we’ve helped global investors navigate the emerging world of tokenized real estate, with projects like Segara Seaside and Lovina Retreat & Wellness Center leading the way.

1-on-1 Strategy Call with our Team

Let’s map out your investment journey.

We invite you to schedule a complimentary 20-minute call with us.

Evaluate if Bali real estate is right for you

Show you how tokenization lowers your risk

Answer your biggest questions

RESOURCES

Download your free e-book and discover how to invest in Bali real estate like a pro:

Get instant access to our 5-day free educational online course to kickstart your tokenization and real estate investments.