The global real estate market, worth over $300 trillion, has historically been limited to institutional investors or individuals with significant capital.

However, as of 2025, real estate tokenization has emerged as a game-changing innovation, democratizing access to property investments. Unlike traditional Real Estate Investment Trusts (REITs), which allow investors indirect ownership through corporate shares, tokenization uses blockchain technology to offer direct fractional ownership of actual properties.

Understanding the distinctions between these two methods can empower investors to make informed decisions.

"The digitalization of real estate diminishes market barriers, augments liquidity, enhances transparency, and streamlines processes within the real estate sector. Blockchain technology offers heightened liquidity, fractional ownership, and fortified security owing to the immutable nature of blockchain."

Tokenization Simplified: Blockchain Meets Real Estate

Real estate tokenization is a process where physical property is represented by digital tokens on a blockchain.

Several platforms have popularized this method, making property ownership accessible from as little as $50. Unlike traditional real estate investments characterized by high costs, complexity, and illiquidity, tokenization simplifies transactions and improves market fluidity.

Since its first pilots in 2018, tokenization has rapidly grown, with a projected market value of $1.5 trillion by 2025.

🏙️ Stay on top of the future of investments

(Real Estate Tokenization News, 15th to 21st of July 2025)

Ripple and Ctrl Alt Partner for Dubai Title-Deeds

Blockchain firm Ripple teamed up with Ctrl Alt to support the Dubai Land Department’s Real Estate Tokenization Project, storing tokenized property title deeds on Ripple’s XRP Ledger. This marks the Middle East’s first government-backed property tokenization initiative and paves the way for fractional ownership of title deeds. (learn more)

Legal Insights: Tokenization in New Jersey & Dubai

Pillsbury Winthrop Shaw Pittman LLP detailed new frameworks in New Jersey and Dubai, highlighting how smart contracts and blockchain can streamline real property transactions and replace outdated land records. They note that integrated legacy systems and regulatory alignment remain key hurdles. (learn more)

Prypco Sells Dh1.75 M Villa in 5 Minutes

In Dubai, startup Prypco sold a Dh1.75 million tokenized villa in under five minutes, demonstrating surging investor appetite for fractional real estate ownership. The rapid sale underscores tokenization’s potential to revolutionize conventional property investment models. (learn more)

Polytrade Secures $6 Million to Boost Tokenization Infrastructure

Polytrade closed a $6 million funding round to expand its real estate tokenization technology, targeting institutional-grade solutions for banks and asset managers. The capital will accelerate development of secure, compliant on-ramps and improve integration with real-world asset (RWA) protocols. (learn more)

Bank of America Sees Stablecoin Boom Boosting Multiple Sectors

A Bank of America analysis forecasted that the recent U.S. “GENIUS Act” stablecoin regulations will fuel growth in sectors ranging from payments and custody to e-commerce and banking infrastructure. The report highlights initiatives like JPMorgan’s tokenized deposits and PayPal USD as early signals of how stablecoins could reshape global payments over the next few years. (learn more)

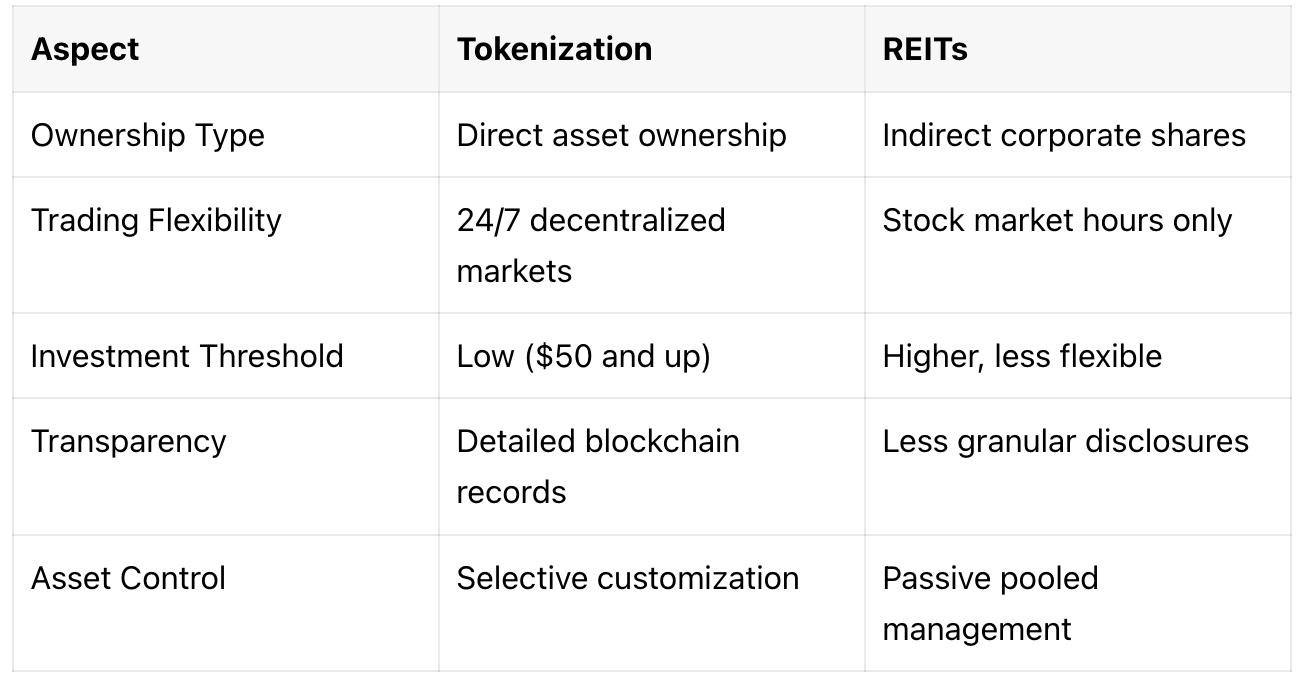

5 Key Differences: Tokenization vs. REITs

1. Direct Ownership vs. Corporate Shares

Tokenization provides investors direct fractional ownership of individual properties through blockchain-backed tokens.

In contrast, REITs offer indirect ownership, meaning investors purchase shares in a corporation that manages a portfolio of properties. While tokenization allows precise asset control and direct property selection, REITs pool investments broadly.

Do you prefer owning specific assets or a broader property portfolio?

2. 24/7 Decentralized Trading vs. Exchange-Restricted Liquidity

Tokenized real estate trades seamlessly around the clock on decentralized blockchain markets, providing unparalleled liquidity.

REIT shares, however, are traded only during regular stock market hours, limiting flexibility. Tokenization enhances investor freedom and responsiveness to market opportunities.

Does constant access to liquidity align with your investment strategy?

3. Affordable Entry Points vs. Higher Investment Thresholds

Real estate tokens can be purchased with minimal investment amounts, often starting as low as $50.

REITs, while accessible to retail investors, typically involve higher thresholds or more restrictive conditions, limiting accessibility for smaller investors.

Is affordability and incremental investing crucial for your financial goals?

4. Transparent Immutable Ledgers vs. Opaque Disclosures

Blockchain ensures every transaction in tokenized real estate is recorded transparently and immutably. Investors can access detailed histories and ownership records.

Conversely, REITs provide less granular disclosures, relying on periodic reports that offer limited transparency into specific property performance.

How much value do you place on transaction transparency and detailed ownership records?

5. Selective Asset Customization vs. Passive Pooled Investments

Investors in tokenized real estate can individually select and customize their property portfolios, targeting specific locations, property types, and risk profiles.

REIT investors, however, passively invest in a broad mix of properties managed by fund managers, offering limited personalization.

Are you seeking active control over your investment choices, or prefer a passive strategy?

Benefits and Risks of Tokenization

Tokenization offers substantial benefits, including global accessibility, swift transaction speeds, and tailored investment opportunities.

Yet, it also poses risks, such as regulatory uncertainties, market volatility, and a steep technological learning curve. Fortunately, by late 2025, regulatory clarity and technology advancements are expected to mitigate many concerns.

Pro tip: Begin investing with small, diversified tokenized assets to manage risk effectively.

Real-World Case Studies

Miami Residential Tokens: Tokenized residential properties in Miami have consistently delivered reliable returns, attracting global investors seeking stable yields.

European Commercial Success: Tokenization platforms for European commercial properties have significantly outperformed traditional REIT liquidity metrics, offering investors rapid market entry and exit.

Bali Invest: Tokenized resort properties in Bali have attracted global attention by providing robust returns and an innovative approach to investing in high-demand tourist areas.

Key lesson: Always select regulated platforms for a secure and rewarding investment experience.

Getting Started with Tokenization

To begin:

Choose reputable tokenization platforms (e.g., Bali Invest, Harbor).

Set up a digital wallet for token storage.

Complete the necessary KYC (Know Your Customer) procedures.

Begin investing according to your financial goals.

Use available resources like specialized apps, investment forums, and regulatory updates to stay informed. Remember, varying laws necessitate professional legal guidance before investing.

In 2025, tokenization distinctly outpaces traditional REITs in terms of accessibility, liquidity, transparency, affordability, and asset control.

As regulatory frameworks solidify, wider adoption and increased investor confidence are anticipated.

That’s a wrap for today.

Talk soon.

Kevin

Do you have any questions about real estate tokenization?

We’re here to help you make informed decisions—not to sell you something you don’t understand.

At Bali Invest, we’ve helped global investors navigate the emerging world of tokenized real estate, with projects like Segara Seaside and Lovina Retreat & Wellness Center leading the way.

1-on-1 Strategy Call with our Team

Let’s map out your investment journey.

We invite you to schedule a complimentary 20-minute call with us.

Evaluate if Bali real estate is right for you

Show you how tokenization lowers your risk

Answer your biggest questions

RESOURCES

Download your free e-book and discover how to invest in Bali real estate like a pro:

Get instant access to our 5-day free educational online course to kickstart your tokenization and real estate investments.